TASC have a well-defined strategy to grow market share in our existing core markets whilst also expanding into new geographies across Europe

Who We Are

-

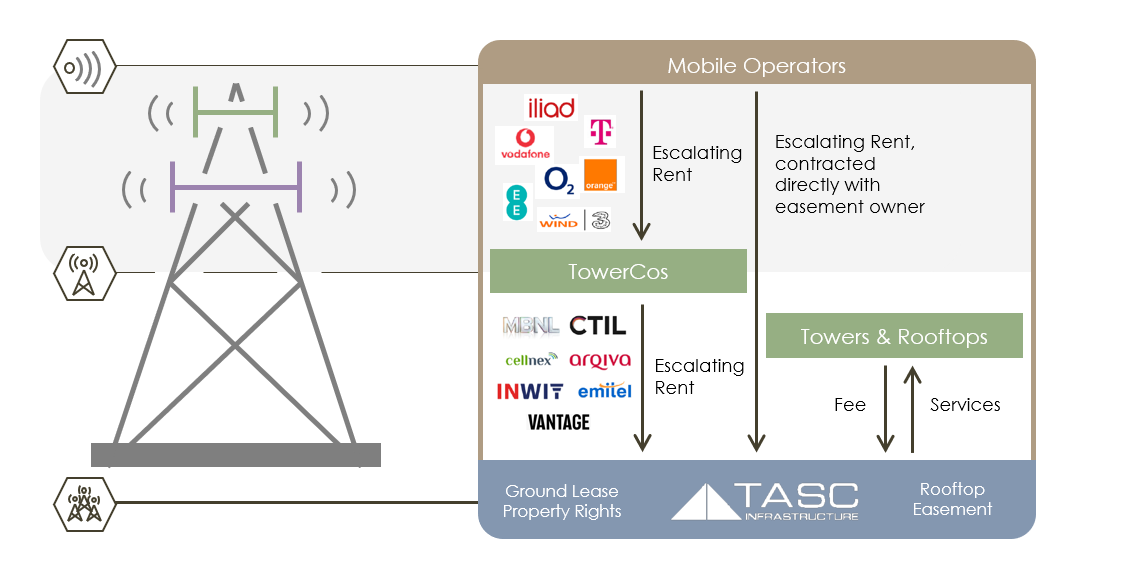

We are an acquirer, owner and manager of rental income streams underlying mobile telecom infrastructure assets.

-

Majority of cash flows come from tenants with strong credit profile and inflation linked lease contracts.

Freehold or long term ownership rights

-

TASC Infrastructure have built up a significant, actionable M&A pipeline for the next 12-18 months.

Across Europe there are already over 300k Points of Presence, in a fragmented market with limited competition. We aim to acquire as many of these as possible that fit within our investment criteria to build a strong, stable rental income.

-

TASC Infrastructure have an experienced management team with 150+ years of telecoms, finance and real estate expertise. Our offices are strategically located to provide the most impact and local expertise in each of the markets that we operate within.

-

Our tenant base includes Europe’s leading mobile operators (“MNOs”) such as Orange, WindTre and Vodafone along with incumbent TowerCo’s across our markets.

A typical contract length can be up to 30 years and is pegged to inflation.

Our Approach

-

TASC Infrastructure have methodical approach to sourcing single sites and leases.

We also pride ourselves on streamlined and quick due diligence and decision making once in discussions with owners.

-

We specialise in acquiring entire site portfolios & negotiate bespoke multiple site agreements with MNOs.

Such portfolios are carefully targeted for attractive site locations, lease rates and terms.

-

We are able to leverage our management’s extensive network in this sector to source bespoke M&A opportunities.

Attractive Lease Characteristics

-

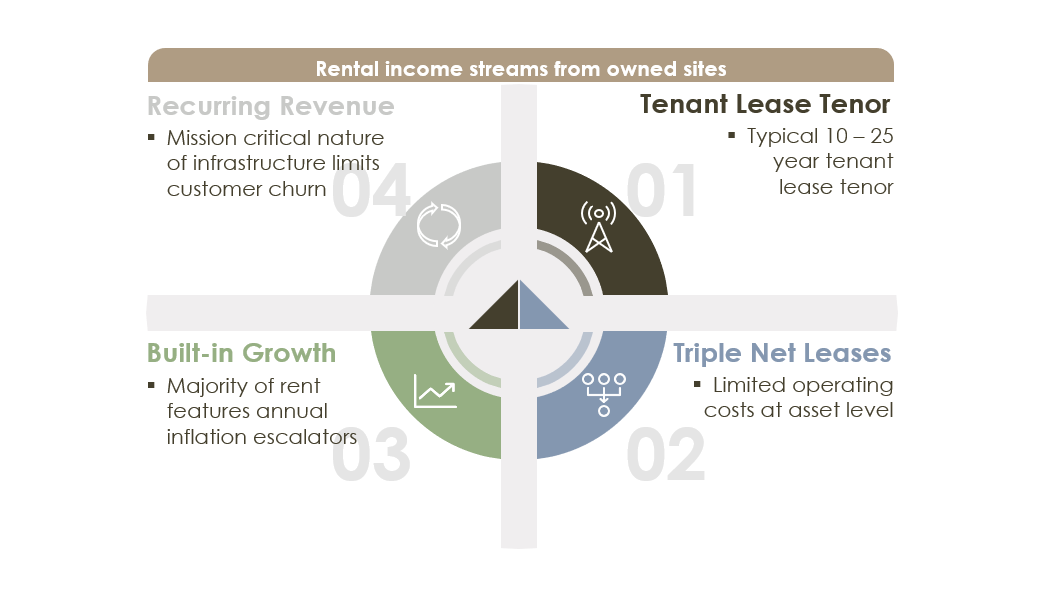

A typical tenant lease duration in this sector is between 10 – 25 years, with rent paid either monthly or annually.

-

Once TASC Infrastructure own a site, there are very limited operating costs at the asset level. The network operators are responsible of the upkeep and power provision of all of their broadcasting equipment.

-

The majority of lease agreements that we enter into features annual inflation escalators pegged to the local inflation index.

This protects TASC’s revenue stream from inflationary pressure.

-

Due to the mission critical nature of this infrastructure to the operators, there is significant limits customer churn.

Customers rely on a network of Points of Presence and to lose such a presence in just one location can significantly affect their wider networks and customer offering.